Policy Administration Automation

Chris Madsen, Head of Global Underwriting Centre, Aegon

Chris Madsen, Head of Global Underwriting Centre, Aegon

Chris Madsen, Head of Global Underwriting Centre, AegonIntroduction

Insurance policy administration is the process of rating, quoting, binding, issuing and managing a policy. Increasingly, with the availability of more and more data, this process is being overhauled. So-called “straight-through-processing” percentages, where policies can go from rating to issuance without any human interaction, continue to go up.

Certainly, consumers and insurers benefit from more information and lower costs. Into this mix, privacy and (anti) selection considerations are thrown and that will likely shift the product space as well in the years to come.

Different Levels of Automation

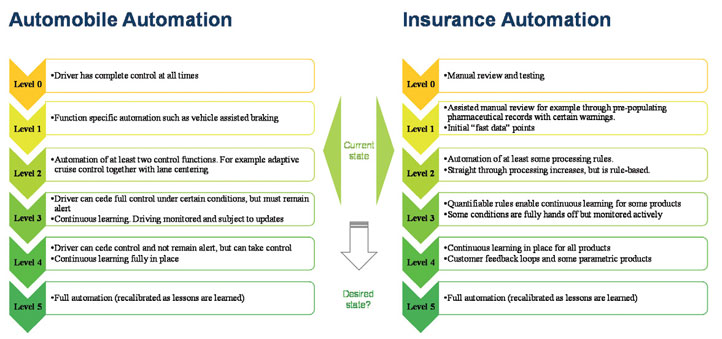

As with autonomous cars, where autonomy is sometimes measured on a scale from 0-5 defined by the Society of Automotive Engineers (SAE), there are different levels of automation in insurance policy administration. This is important to recognize as it has significant implications for how automated and adaptable a framework really is.

Check Out: Top Insurance Technology Companies

Figure 1: As with autonomous cars (https://www.sae.org/), there are different levels of insurance automation

As shown in Figure 1, historically policy administration was a manual process.

This has evolved, but in many cases, the level of automation in the rating process, for example, stops short of being able to integrate new data sources without manual intervention and does not include a continuous learning capability. In many cases, there are valid reasons for at least some manual processing as integrating new data sources needs to be done carefully and may in some cases require regulatory interaction.

In the near future, we will likely see more parametric insurance in the form of smart contracts on distributed ledgers potentially containing both electronic health records and payment information

One can certainly envision frameworks that move beyond the rule based mappings that currently exist to something that is more joint probability based and therefore better able to integrate new data sources. As this happens, more frequent touch points between insurer and insured are possible potentially benefitting both. Yet, this also introduces new considerations as the equilibriums that define the current underwriting space shift.

The Modularization of the Insurance Value Chain

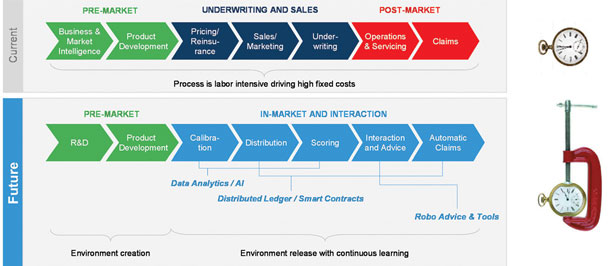

Historically, there was a clear pre-market process followed by underwriting and sales and then post-market operations and claims management. Each insurer managed most of this process from beginning to end – often with the support of one or more reinsurers. As insurtechs have emerged to fill the gap between insurers’ own capabilities and the desires of customers, this process is being modularized.

This leads to outsourcing of different components of the chain. For example, underwriting is increasingly risk scoring using electronic data sources that will increasingly take into consideration some new pieces of information such as that available through wearables. Several insurtechs are specializing in this, which then raises the question if an insurer wants to develop this internally or simply partner with in insurtech provider. Increasingly, each step of the value chain is facing this question.

Figure 2: The insurance value chain is becoming modularized, where each module contributes to an environment - ultimately with continuous learning

The extension of this is that it becomes a key strategic consideration for each insurer to define the areas that it wants to excel at and which ones can be efficiently outsourced.

As this happens, it further supports an entirely different experience – from inception to claims. What used to be a product that was launched and maintained for years now becomes an environment that is launched that will realistically shift real-time, subject to laws and regulation, both in terms of the risk assessment and the ingredients.

In the near future, we will likely see more parametric insurance in the form of smart contracts on distributed ledgers potentially containing both electronic health records and payment information. This is when we will first begin to approach “Level 5” of insurance automation.

Concluding Comments

Policy administration automation has the potential to significantly benefit consumers – making it feasible to assist customers with health management and make insurance more engaging and prevention focused. This can have significant benefits. For example, for customers with chronic illnesses who traditionally may have been declined, even though they effectively manage their condition, this is a great win.

At the same time, with more data and automated analytics also come the risk of loss of solidarity and unintended consequences. It is vital for any contributor into this environment to consider this explicitly while recognizing that the space will continue to evolve. Ultimately, it requires cooperation between insurers, consumers and regulators to help ensure the most beneficial outcome.

Read Also